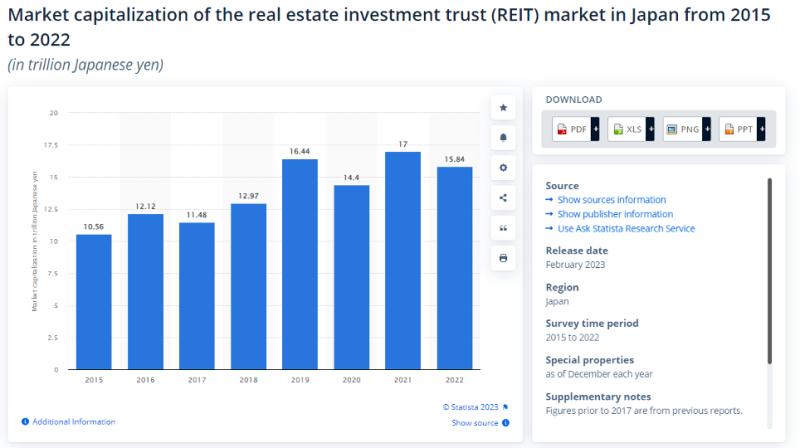

Navigating the Landscape of J-REITs: A Surge in Japan's Real Estate Securitization

Introduction

Let's cut to the chase: real estate, while being a traditional investment stronghold, is no stranger to the whims of economic turbulence. Japan, in its bid to revitalize a somewhat stagnant property market, embraced J-REITs (Japan Real Estate Investment Trusts). But what does this really mean for the average investor, the economy, or the market at large? It's high time we stripped down the highfalutin jargon and examined the bare bones of J-REITs.

Historical Context: Not a Bed of Roses

Real estate securitization didn't just pop out of thin air. It's been around, with Japan catching on rather late in the game. The early 2000s saw the launch of J-REITs, a move lauded as a market revolution. But let's be clear: it was less of a strategic masterstroke and more of a necessity. The country needed to thaw its frozen real estate assets and stir some life into its investment sector. J-REITs offered a way to pool money into something that felt solid — commercial spaces, apartments, shopping centers, you name it.

Regulatory Framework and Market Dynamics

J-REITs operate within a spiderweb of regulations — a necessary evil to prevent the market from turning into the Wild West. The Financial Instruments and Exchange Act keeps things on a tight leash, dictating everything from asset acquisition to how dividends dance into investors' pockets.

But here's the kicker: the market is a beast of its own. Urbanization trends, the graying populace, economic policy flip-flops — they all toss the J-REIT market around like a hot potato. The aging demographic, coupled with the exodus to cities, skews investment towards healthcare facilities and urban housing. But it's a delicate house of cards, vulnerable to the slightest economic sneeze.

The Economic Impetus of J-REITs

Here's the unvarnished truth: J-REITs are a gamble. They've opened the property market floodgates, sure. They've made property investment a playground not just for the big guns but also for Joe Average. However, they're no magic bullet for economic stagnation. They've revved up market liquidity and reined in some of the wilder speculative tendencies, but let's not don party hats just yet.

The Road Riddled With Potholes

J-REITs aren't cruising on easy street. They're up against market mood swings, global economic shockwaves, and cutthroat competition for property acquisitions. They're bobbing in choppy waters, but their saving grace has been adaptability. They're not throwing in the towel, using tricks like not putting all their eggs in one basket, sprucing up assets, and peeking over international horizons for breathing space.

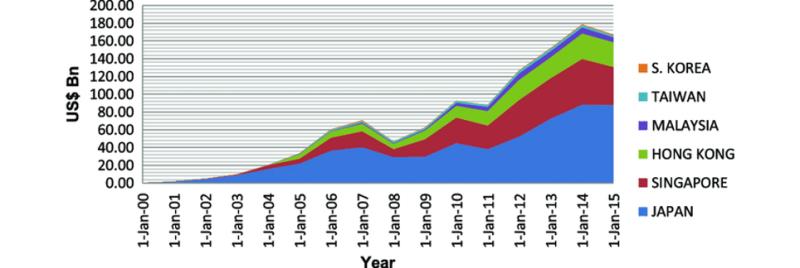

The Global Echoes: Learning from Others' Playbooks

When we zoom out to a global scale, it's clear that Japan isn't alone in its J-REIT journey. Take the United States, for example, where REITs have been in play since the 1960s, offering a glimpse into a mature market and perhaps a crystal ball into Japan's potential future. The U.S. model underscores the importance of diversification, with REITs investing in everything from shopping malls to data centers and even cell towers, reflecting the evolving economic landscape and consumer habits.

However, it's not all sunshine and rainbows. The U.S. REIT market has faced its share of storms, particularly during economic downturns like the 2008 financial crisis, when over-leveraging and a housing market bubble led to a significant REITs' value plummet. The lesson here for J-REITs is the importance of maintaining a balanced portfolio, keeping debt levels in check, and staying adaptable to economic and societal shifts.

Across the pond, in Europe, REIT regimes vary significantly, with some countries offering more favorable conditions than others. France and the UK, for instance, have established REIT systems that encourage investment in local real estate, while providing tax incentives. These European models, especially in the context of economic integration and regulatory harmonization, highlight the potential for cross-border REITs investments and the possibility of a more interconnected real estate investment environment.

Navigating Through International Waters: A Strategy for Resilience

Expanding the scope beyond domestic shores, J-REITs have the opportunity to mitigate risk through international investments. This strategy could serve as a buffer during domestic market downturns, providing a safety net against local economic shocks. For instance, Singapore’s REIT market, known for its significant international property portfolio, demonstrates resilience by distributing risk across geographical locations.

Moreover, looking towards emerging markets could unlock new growth avenues. Countries with rapidly developing economies, such as Vietnam or the Philippines, present untapped potential with their urban development projects and burgeoning commercial sectors. These markets, with their relatively high yield rates, offer a compelling case for inclusion in a diversified investment strategy.

However, this approach is not without its pitfalls. Navigating different regulatory landscapes and economic climates requires a keen understanding of local market conditions, solid investment acumen, and an adeptness at predicting global trends. Thus, while international diversification could be a boon for J-REITs, it necessitates a sophisticated strategy, combining local market expertise with a global investment outlook.

A Global Perspective: Why Not Cyprus?

Speaking of global, investors feeling hemmed in might want to glance at Cyprus. It's a breath of fresh air with its burgeoning real estate scene. Whether it's the scenic allure or the promising economic strides, properties here are worth a gander. Platforms like Index.cy bridge the gap, offering a smorgasbord of options from their catalog. It's a far cry from the rigidity of traditional markets and worth considering in a diversified portfolio.

Conclusion: No Sugarcoating

Wrapping up, J-REITs are a mixed bag. They've shaken up Japan's investment landscape, sure. They've dangled the carrot of profitable returns in property investment. But they're not a panacea. They're shackled by market realities, economic uncertainties, and the global financial climate. Their future isn't set in stone; it's a path strewn with risks and opportunities.

More to Read:

Previous Posts: